Mastering Financial Planning: How to Achieve Wealth Growth Through Smart Strategies

Financial planning is no longer a privilege reserved for the wealthy—it is a life skill that everyone should master. Through scientific financial planning, investment strategies, and risk management, you can secure your financial future and even achieve wealth growth.

💡 This article will guide you through the fundamentals of financial planning, practical tips, and real-world data to help you create a better financial future!

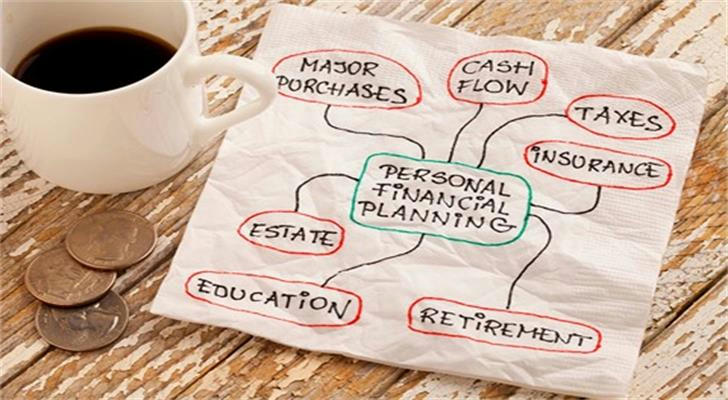

💡 What is Financial Planning?

📌 Financial planning refers to the scientific management of income, expenses, assets, and liabilities to achieve financial goals.

💰 Financial planning includes:

✅ Savings: Managing daily expenses and developing a saving habit.

📊 Budgeting: Controlling spending and avoiding unnecessary expenses.

📈 Investment Strategies: Using stocks, funds, bonds, and real estate to grow wealth.

⚠️ Risk Management: Reducing financial risks through insurance and asset allocation.

📊 According to Investment Company Institute (ICI):

🔹 Average household annual savings rate: ~6%

🔹 Long-term investment (e.g., stock market) annual return rate: ~7%-8%

🎯 Smart investing accelerates wealth growth better than saving alone!

🔍 Why is Financial Planning Important?

✅ 1. Plan for the Future, Avoid Financial Crises

📌 Reality: Many people face financial difficulties when dealing with unexpected events (e.g., illness, job loss).

📊 Data: According to Fidelity, 70% of households lack sufficient savings for unexpected financial crises.

💡 Solution: Build an emergency fund that covers 3-6 months of living expenses to prepare for uncertainties.

✅ 2. Wealth Growth – Make Money Work for You

📈 Investment vs. Saving:

🔹 Savings account interest rates are usually below 1%, failing to keep up with inflation.

🔹 Stock market (S&P 500) historical average return: ~8% per year, providing significant long-term returns.

📌 Example: If you start investing $500 per month at an 8% annual return, you will accumulate over $745,000 by age 60!

✅ 3. Diversify Risks, Maintain Financial Stability

📊 Research shows that proper asset allocation (30% stocks + 40% bonds + 30% cash) reduces investment volatility by ~20% (Source: Vanguard).

⚠️ Avoid putting all your eggs in one basket—diversify investments to lower risks.

✅ 4. Achieve Financial Freedom & Improve Life Quality

📌 Financial freedom = Living life on your own terms without money worries.

📊 Dave Ramsey’s research suggests that with 10-15 years of disciplined saving and investing, anyone can achieve financial freedom!

📌 Basic Financial Planning Strategies

📝 1. Budgeting & Expense Control

✅ Use budgeting tools or financial apps (e.g., Mint, YNAB) to track income and expenses.

📊 Survey: 60% of adults fail to follow a budget annually (Mint).

💰 2. Develop a Saving Habit & Build an Emergency Fund

📌 Emergency fund recommendation: Save 3-6 months of living expenses for emergencies.

📊 Reality: 40% of U.S. adults cannot afford an unexpected $500 expense (Federal Reserve data).

📈 3. Investing & Asset Allocation to Grow Wealth

✅ The power of compound interest (described by Einstein as the 8th wonder of the world).

📊 Warren Buffett’s recommendation:

🔹 60% in stocks (high growth potential).

🔹 40% in bonds (stable returns, lower risk).

🔒 4. Insurance Planning to Mitigate Unexpected Risks

📌 Reality: Most families overlook insurance, making them financially vulnerable in emergencies.

📊 Data: 70% of households have health insurance, but only 40% plan for long-term risks (Allianz).

✅ Recommended policies: Health insurance, life insurance, and accident coverage to secure financial stability.

🔄 5. Regularly Review & Optimize Financial Plans

✅ Check financial status regularly (adjust every 6 months).

📊 JP Morgan Chase research: Periodic portfolio adjustments significantly improve long-term wealth growth.

⚠️ Common Financial Planning Mistakes

🚫 Mistake #1: Relying Solely on Savings Accounts

🔹 Traditional savings account interest rates < 1%, while inflation is around 3%!

✅ Better strategy: Use index funds, bonds, ETFs, and other tools for stable growth.

🚫 Mistake #2: Ignoring Risk Management

📊 Research shows: Diversification reduces investment volatility by over 30% (Source: Morningstar).

✅ Solution: Diversify investments to avoid overexposure.

🚫 Mistake #3: Focusing Only on Short-Term Gains Instead of Long-Term Planning

📌 Long-term financial goals (e.g., buying a house, retirement planning) are more critical than short-term investments!

✅ Advice: Set 5-year, 10-year, and 20-year financial goals and achieve them step by step.

🎯 Conclusion: Financial Planning is Essential for Everyone!

✅ With smart financial planning, you can:

💰 Save wisely & prepare for financial emergencies.

📈 Invest smartly & achieve wealth growth.

🛡️ Get proper insurance & protect your family’s future.

🎯 Ultimately, achieve financial freedom & enjoy a better quality of life!